JANALAKSHMI FINANCIAL SERVICES

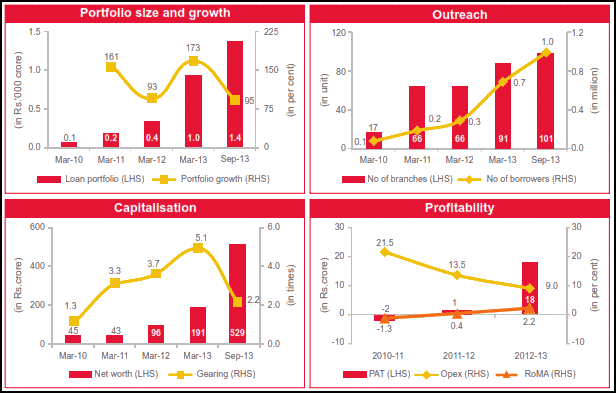

Apart from microfinance (94 percent of the total loan portfolio as on March 31, 2013), the company also offers other loan products such as enterprise loans, housing loans, and individual loans. As on September 30, 2013, Janalakshmi had a network of 101 branches, with outstanding loans of Rs.1,409 crore. The company operates in 11 states, with Karnataka and Tamil Nadu together accounting for 53 percent of its loan portfolio as on March 31, 2013 (65 percent as on March 31, 2012). Performance on key parameters

Janalakshmi is the fastest-growing large MFI. Its portfolio outstanding and borrower base have grown at a CAGR of 140 and 104 percent respectively during the 3 years ended March 31, 2013 Has sound processes and systems. The 30+ days past due was low at around 0.3 percent as of September 30, 2013. However, the ability to replicate processes in new geographies and maintain asset quality over the medium term is critical Dependence on wholesale funding from banks/ financial institutions is high at around 85 percent as on September 30, 2013; has a relationship with 30 lenders and raises funds from securitization regularly Capitalization remains healthy. Raised capital of Rs.325 crore (Rs.222 crore of equity capital, Rs.60 crore of compulsorily convertible preference shares, and Rs.42 crore of compulsorily convertible debentures) in August 2013 Reported a net profit of Rs.19.2 crore during the half-year ended September 30, 2013, as against a net profit of Rs.3.5 crore in the corresponding period of the previous year. The ability to control operating expenses and credit costs while pursuing aggressive growth is critical and will determine earnings profile over the medium term.